test

Helping people with disabilities keep their assets and live their most meaningful lives, while maintaining eligibility for NY state government benefits like Medicaid and SSI.

Why a Community (Pooled) Supplemental Needs Trust?

If you meet the medical criteria for government benefits, such as NYS Medicaid or SSI, but have concerns about asset limits affecting your eligibility, a Supplemental Needs Trust can help you preserve your assets while maintaining access to these vital programs.

While benefits like NY State Medicaid support residential, health, and safety needs for individuals in NY State with disabilities, the ability to shelter additional funds in a community trust means the freedom and independence to vacation, supplement rent, enjoy entertainment and other recreational, life-enhancing activities that benefits do not cover.

Administering a Special or Supplemental Needs Trust can be more complicated than managing other trusts.

With a Community Supplemental Needs Trust, also known as Pooled SNT, a non-profit organization acts as Trustee. They handle investing funds, making payments, paying taxes, and keeping detailed financial records. This involves understanding government regulations and programs, including specific rules about using supplemental needs assets. Failing to follow these rules can jeopardize one’s eligibility for government benefits based on financial need.

Beneficiaries maintain their own private accounts for personal needs. The trustee “pools” the accounts together for management and investment purposes, allowing for greater diversity and lower administrative cost.

Individual Supplemental Needs Trust accounts that are pooled together in this manner are referred to as “Sub-Accounts”.

You do not need to be a member of a CCO to apply for or open an account with My Choice Trust.

A Few Highlights of our Community Supplemental Needs Trust

About Us

My Choice Trust

My Choice Trust is sponsored by Coordinated Care Alliance NY (CCANY), a Management Service Organization born out of the collaboration of two NY State 501 (c)(3) non-profit Care Coordination Organizations – LIFEPlan CCO and ACANY.

Together, these Care Coordination Organizations, also known as CCOs, provide responsive, high-quality Care Management Services and support for more than 50,000 individuals with intellectual and/or other developmental disabilities throughout 48 counties in NY State.

*You do not need to be a member of a CCO to apply for or open an account with My Choice Trust.

Person with a qualifying disability wishes to apply for or needs to maintain government benefits, like NYS Medicaid.

Government benefits fund shelter, medical and dental care, assistive devices, programs and more.

To qualify for and maintain eligibility for these benefits, one must not exceed restrictive asset limits.

If one needs to shelter assets above benefit limits in order to qualify for or maintain these benefits, there are options.

Disbursements from the SNT can be requested for the sole benefit of the beneficiary to supplement items that benefits do not cover.

Trust Overview

Understanding Supplemental Needs Trusts

Anyone eligible for income and asset capped (known as means-tested) government benefits, that has or will be receiving assets above the eligibility limits, can quickly and easily open an account, protect these funds to utilize throughout their lifetime, and avoid denial or interruption of benefits.

- To qualify for NYS Medicaid and/or Supplemental Security Income benefits, one must have a qualifying disability as defined by the Social Security Administration.

- Additionally, there are limits to the amount of money one can have in their name.

- If someone should acquire additional resources that puts them above these limits, they would be in danger of losing these benefits.

- Opening a supplemental needs trust account would enable one to shelter these excess resources and keep them safe for personal and recreational use throughout their lifetime. They can supplement services they are receiving through government benefits and still maintain eligibility for benefits.

- While funds held in a Community SNT are not considered by Medicaid or SSA, you will still need to notify the entities once you have opened an account.

| Medicaid Resource Limits 2024 | Monthly Income |

Assets |

|---|---|---|

| Individual | <$1,800 | <$32,396 |

| Married Both Applying | <$2,433 | <$43,781 |

| Married One Applying (Applicant) | <$1,800 | <$32,396 |

| Married One Applying (Non-Applicant) |

<$3,948 | <$157,920 |

| SSI Resource Limits 2024 | Monthly Income |

Assets |

|---|---|---|

| Individual | <$1,971 | <$2,000 |

| Married – Combined | <$2,915 | <$3,000 |

*SSI does not factor separate limits or benefits for married couples

“Asset Limits” do not include IRAs or 401Ks that are in payout status, your home and the land that is on (as long as you live there or will be returning there), one vehicle per household, household items, personal belongings, a burial fund up to $1,500 or a life insurance policy with a cash value up to $1,500.00, non-refundable pre-paid funeral arrangements, unlimited term life insurance and whole life insurance with a face value of $1,500.00 or less.

Sheltering additional funds in a trust means the freedom and independence to vacation, enjoy entertainment and other recreational activities that benefits do not cover, and now qualify for the Medicare Savings Program (at least $185 monthly).

*For information on eligibility and qualifications for NYS Medicaid please visit New York State Department of Health or the Office for People with Developmental Disabilities (OPWDD).

*For Supplemental Security Income qualifications, please see SSA.gov.

*For information on Supports and Services available to people with intellectual and/or developmental disabilities in NYS, please visit the Knowledge Center.

Benefits of a Community Supplemental Needs Trust

- Managed by non-profit organizations, with a financial institution as co-trustee.

- While each beneficiary retains their own account of assets, these accounts, often referred to as sub-accounts, are “pooled” for managing and investment purposes.

- The pooled management of accounts enables highly skilled trustees to combine and manage resources cost-effectively, resulting in lower administrative costs to the beneficiaries.

- When many sub-accounts are managed together, they have access to a wider array of investment opportunities, including greater diversification, which can reduce risk.

- Documents already drafted and approved by Medicaid and SSA.

- Hold assets for exemption from limits to be used as needed for items not covered by Medicaid.

- Managed by individuals who are well-versed in special needs planning, keep abreast of changing benefit rules and are knowledgeable about local services.

- If an individual with disabilities has no living parent or grandparent, the opportunity to utilize a pooled trust as opposed to working with the courts may be preferable.

- No age limitations.

Benefits of the My Choice Community Trust (in addition to the above)

- Minimum funding to open an account is $250.

- Once the Joinder Agreement (application) is completed in full, notarized, and submitted, the enrollment process typically takes approximately 1 week.

- Available throughout NY State

*NOTE Any funds remaining in the account after the passing of the beneficiary will be retained by the trust for the sole purpose of supporting other individuals with disabilities.

Where To Begin

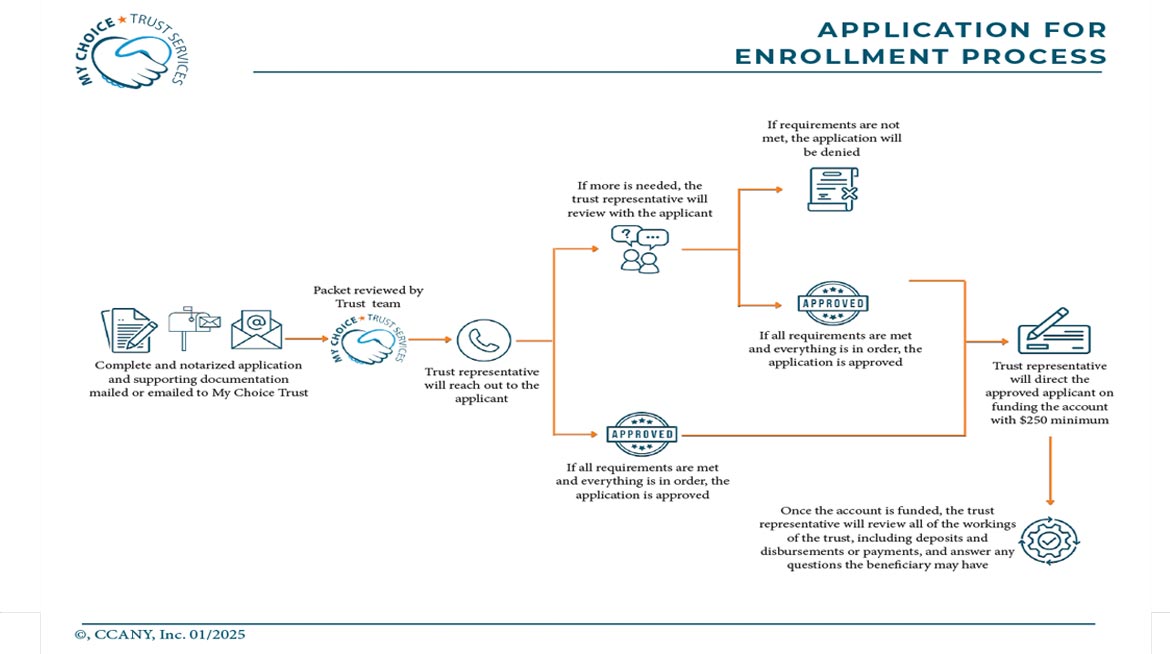

Steps to Establishing an SNT Account

Establishing an account for the My Choice Trust can be handled in a few simple steps as outlined below.

To participate in a Community SNT, the Beneficiary must have a qualifying disability as defined by Social Security. If you are not yet receiving government benefits like SSDI, SSI or Medicaid based on disability, you may need to request disability determination through Medicaid.

Once you have opened an SNT account, if you are receiving Medicaid or SSI, you must notify the entities of the account.

Once you have an Established Account – Funding and more

A member of our team will contact you to welcome you to the My Choice Trust Family.

We will review the process, walk you through funding the account, explain hard copy checks as well as online deposits, disbursement requests, and any other items you wish to discuss.

Joinder Agreement (Application for Enrollment)

- Complete the Joinder Agreement in full, sign, date and have notarized. This is the primary document needed to apply for the SNT account.

- If signed by Guardian or POA, a copy of the legal document granting authority must be included.

Supporting Documentation

- Copy of Beneficiary’s Social Security Card

- Copy of SSA Award Letter, or SSA 1099 (if you are receiving SSI or SSDI).

- If you are not yet receiving Medicaid or SSI, we will need documentation of disability determination through the Social Security Administration

- Copies of any Guardianship or POA paperwork.

- If the account creation is due to a court order, submit a copy of the order.

Mail or Email the Packet

- Submit the Joinder/Application along with all supporting documentation either by mail or email:

- My Choice Trust Services 258 Genesee St. Mezzanine Level, Utica, NY 13502

- Or email to intake@mychoicetrust.org

- Once we review the packet, a Trust Representative will reach out to you for next steps.

- If approved, your Trust Representative will direct you through funding the account.

Brief tutorial videos and flowchart for the SNT process

Withdrawals and Payments

Funds sheltered in supplemental needs community trusts are intended to supplement the supports and services covered by NY State Medicaid, SSI, or other means-tested government programs. They are intended to enhance the life of the beneficiary and therefore, withdrawals and payments, also known as disbursements, should be requested for direct payment to third parties for items not otherwise covered by government benefits. All withdrawal requests will be reviewed on an individual basis. Approval is at the discretion of the trustees.

Requests must meet the guidelines below:

- Must benefit the account Beneficiary.

- Must be accompanied by a bill or invoice in the name of the Beneficiary.

- Invoices must be clear and indicate that the service is for the Beneficiary.

- Must be for a legitimate business.

- Must have incurred within 90 days of the request submission.

Once all of the above items are in order:

- Complete the appropriate Withdrawal Form (one time or automatic) from the document library on our site.

- Submit by either option below.

MAIL: Download, print, and mail the completed form with the supporting invoice and/or documentation to:

My Choice Trust

258 Genesee Street, Mezzanine Level Utica, NY 13502

EMAIL: Download the completed and saved form and email this form, along with the supporting invoice(s) and/or documentation to:

Request@MyChoiceTrust.org

Document Library

Please click the tiles below to download the document. Once downloaded, you can either fill in electronically and save with a new name to your hard drive or print the document to complete by hand in hard copy. Documents requiring signatures will need to be printed and signed. From there, you can either scan and upload for electronic submission or mail in the hard copy.

FAQ’s

Community SNTs vs ABLE Accounts

ABLE Accounts and Community SNTs both offer a way to safeguard resources and preserve financial eligibility for benefits.

You can have an ABLE Account and a Community SNT at the same time to maximize resources available.

| ABLE Account |

|---|

| The beneficiary can manage their own account, or an authorized representative can manage it for them |

| Disability onset prior to the age of 26 |

| Only one ABLE account permitted per individual but may also have an SNT |

| Maximum annual contribution of $18,000 |

| If the account grows to $100,000.00, SSI will be suspended until the ABLE account balance drops well below that level |

| $520,000 maximum holding |

| Ability to utilize a debit card for the account |

| Very easy and inexpensive to set up |

| Community SNT |

|---|

| The beneficiary or authorized representative can manage the account along with the non-profit organization/trustee to manage disbursement requirements, trust laws, and tax records related to disbursed taxable income |

| No age requirement – must meet the social security disability requirement |

| May have multiple SNTs along with an ABLE account |

| No limits to the contribution amounts – ideal for large settlements or inheritances |

| Amounts do not impact benefits |

| No maximums |

| Debit card use would be treated as income and therefore disbursements should be requested as outlined, or for time sensitive purchases, credit cards can be utilized (see information and procedures document) |

| Easy enrollment and can be set up with as little as $250 |

Helpful Resource Links

Contact Us

Representatives are available to speak with you Monday through Friday, 8:30 am – 4:30 pm.

If we are not able to take your call, please leave a message and we will return your call as soon as possible.

You can also reach us by email at the address below.

We look forward to hearing from you.