Supporting people with intellectual and developmental disabilities (IDD) takes good policies, a strong workforce, and steady funding. CCOs want to help.

What we’re doing:

We’re asking lawmakers to make simple, practical changes that keep people safe, reduce stress on families and staff, and make care more reliable. Our goals focus on better access to services, more flexibility, and strong support for the workers who provide care every day.

Why it matters:

When care is easier to give and easier to get, people stay healthier, families feel supported, and our communities grow stronger.

People with intellectual and developmental disabilities deserve better. Their families deserve better.

It’s time to invest in dignity, fairness, and the future of community-based care.

Our Hopes for System Change Are Simple:

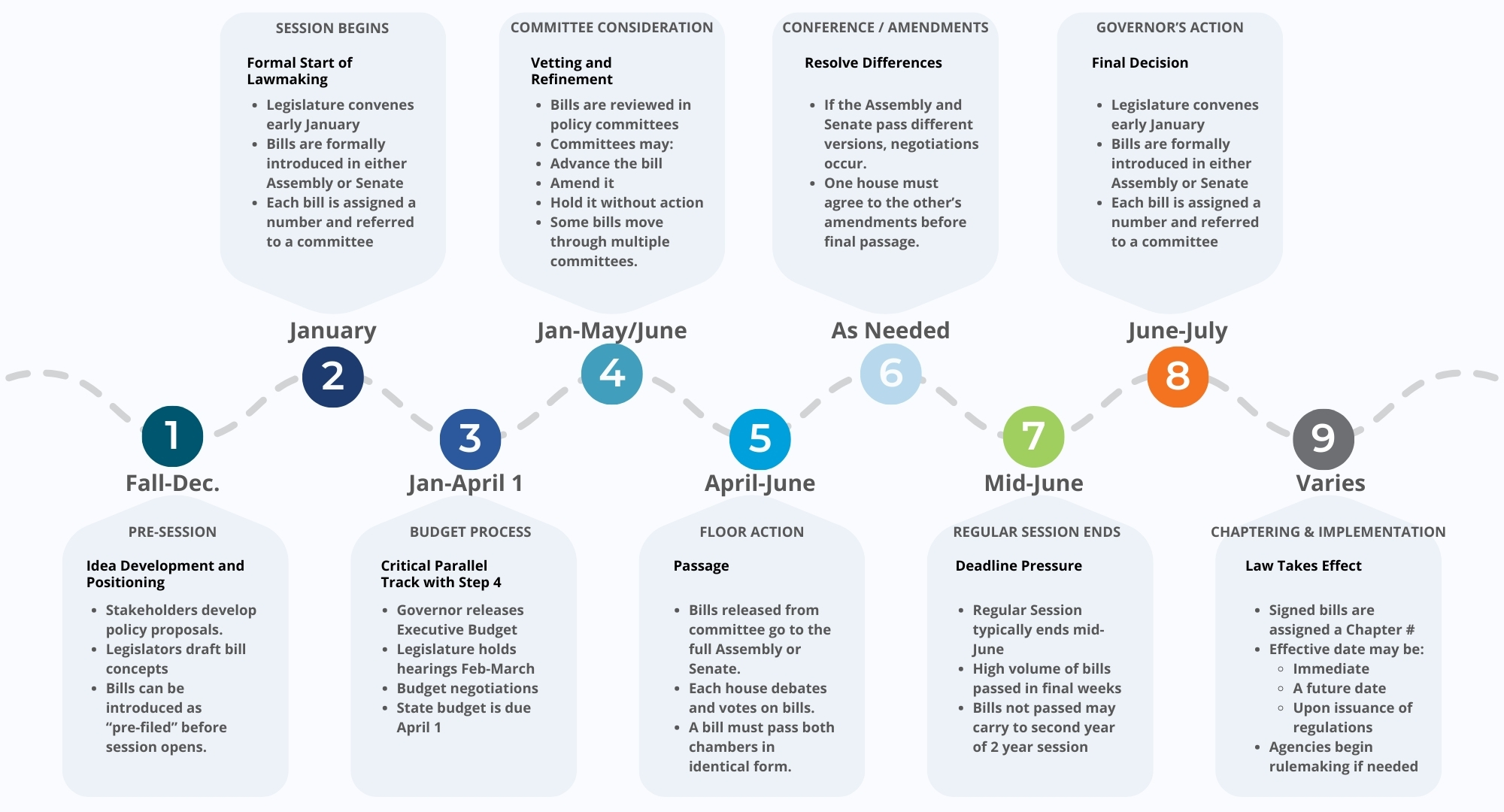

NY State’s Legislative Timeline

Click on the steps below for more detail:

Advocacy Toolkit

Make Your Voice Heard!

Resource links

Document Library

Contact Us/Media Inquiries

Who is the contact